Don’t get too excited that was the warning from Gartner, the global research firm that identified the digital technology hype cycle, and in 2019 put Customer Data Platforms (CDPs) firmly at their peak.

.jpg?width=1024&height=683&name=938686_BlogImageRebrand_072621-1024x683%20(1).jpg)

The shape of that cycle a steep rise from innovation to inflated expectations is predicted to crash quickly back down into a “trough of disillusionment.” Yet in 2020, Gartner acknowledged that CDPs hadn’t progressed through the hype cycle as quickly as they’d anticipated. More information, more options, and more vendors were keeping CDPs from descending into the realm of disillusionment. (1)

But are marketing professionals right to be worried about what lies ahead for CDPs? Should they hold off on investing in the technology out of fear of disillusionment? Is the idea of predictive marketing and accurate data points across a completely connected customer journey a unicorn?

Experienced marketers have seen similar hype before. Many CMOs remember the enthusiasm over the potential for MAPs in the past decade and the exciting (maybe unrealistic) expectations for how they’d revolutionize marketing. Should marketing teams be wary of investing in CDPs for fear of the same letdown they might have experienced with MAPs?

Realistic Expectations

As Gartner’s hype cycle shows, disillusionment with new technology is inevitable, because the peak of the fervor is inflated expectations. While MAPs are a powerful and useful tool, most marketers’ disappointment in them has come from expecting things that either weren’t possible or that they didn’t have the data or architecture to achieve (2). So while CDPs may currently be being hyped as the all-in-one solution for every customer experience goal, that doesn’t mean they aren’t a powerful and indispensable tool in your marketing stack.

There’s a lot of confusion about CDPs and their potential (especially because they are so customizable), but the purpose of this article is to demonstrate what is genuinely achievable through a CDP and how they can help marketers realize the full potential of their MAPs.

CDP Growth

A glance at the growth of the CDP industry in the last 5 years is enough to convince someone that either there’s something to this trend or a whole lot of companies have gotten it very wrong. Adobe’s acquisition of Marketo (and subsequent development of their Realtime CDP), Salesforce’s acquisition of MuleSoft, Datorama, and integration with Salesforce CDP, and other big-name companies who have been heavily investing in campaign CDPs to add to their software suites all show that this technology isn’t a flash in the pan.

Realizing Your MAP’s Potential with a CDP

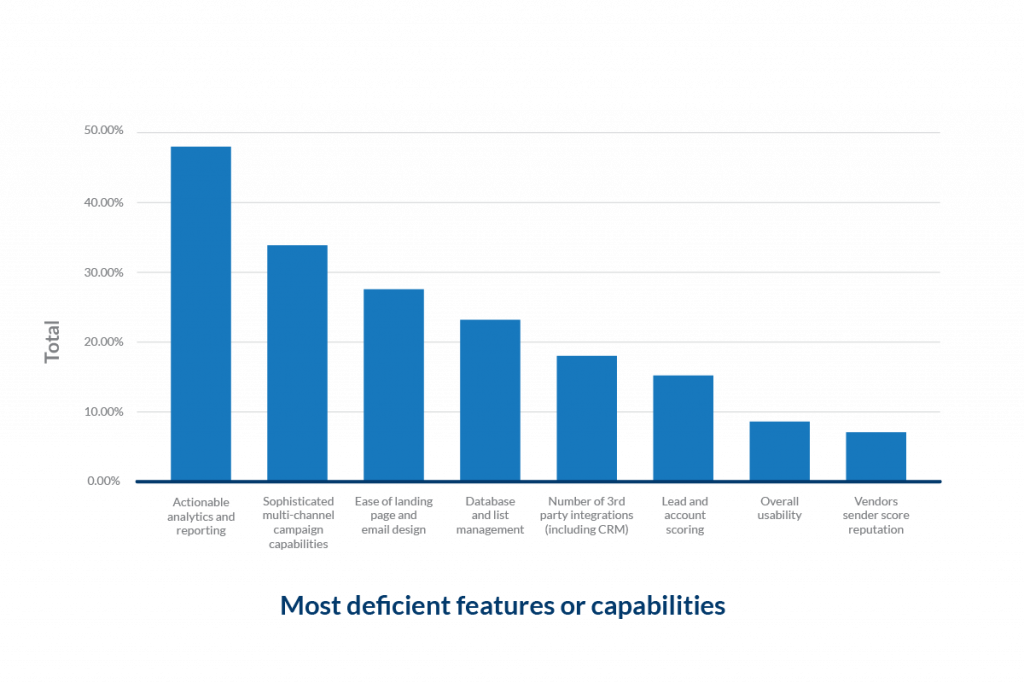

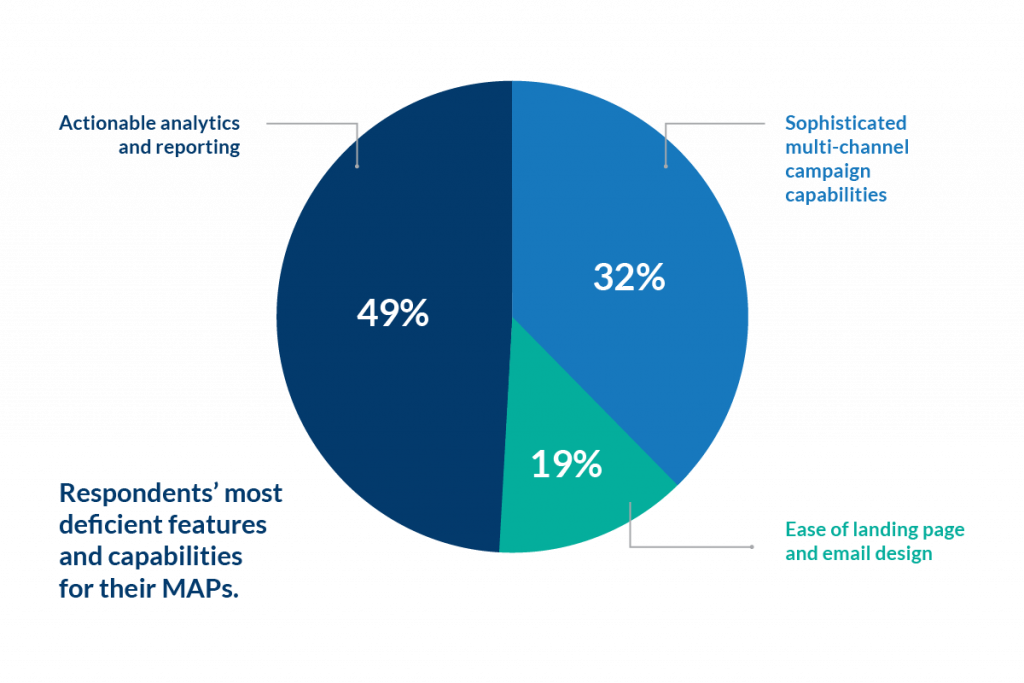

In the 2020 Map Customer Satisfaction Benchmark Report, marketers reported significant dissatisfaction with the capability of their MAPs, especially when it comes to reporting and analytics (2). The movement toward a 360-degree customer view with real-time updates based on customer interactions has revealed gaps in the power of MAPs to provide marketers with the reporting they need. Put simply, MAP solutions alone aren’t able to keep up with the current demands of marketing teams.

But with a CDP in the mix, data from across channels and touchpoints can be assembled, streamlined, meet privacy requirements (while intelligently ignoring bad data), and then provide it to MAPs and a host of other outlets for activation of that data. CDPs are uniquely capable of enabling in-the-moment automation, creating the personalized customer journey that marketers crave.

Which feature or capability in your MAP are you most dissatisfied with?

Potential for Growth and Realistic Implementation

Recent investment in CDPs by big software companies is a signal of where the market is moving. Companies who expect to be competitive going forward can’t delay the implementation of CDP technology in their marketing. If you’re not leveraging your data to identify actionable implementation, you’re already behind. For marketers struggling to realize the full value of their MAPs, there are three areas of growth where CDPs will be essential.

First, in aligning marketing goals with revenue-generating performance metrics that company leadership are most interested in.

Second, identify marketing’s role in your sales stages, and the metrics needed to create meaningful, actionable data in relation to these stages. And third, accurate sourcing and scoring of leads.

Revenue Generation

With the advent of CRMs and MAPs, marketers focused on improving the quality of their data to drive better decision-making. However, the new direction of MAP actualization is in connecting marketing performance to measurable revenue goals. By aligning marketing objectives with those of sales departments and then producing metrics demonstrating sourced revenue, revenue influence, and opportunity creation, marketing departments can demonstrate their viability and ROI to leadership.

Maps alone can’t produce this kind of data, but CDPs can capture and unify disparate data strands to track and report customer behaviour and interaction from initial contact to purchase and beyond. This data in turn influences marketing decisions that further drive revenue.

Sales Stage Identification

Marketing departments are left floundering when there is a lack of communication about specific sales goals and especially the way sales stages should be identified. By working with sales teams, the steps in the customer pipeline can be identified, goals set for each stage, and most importantly, metrics created and utilized to further refine and improve the process.

MAPs can function at a higher level when they have access to data from many different first, second, and third-party sources. Already on an upward trend, the COVID-19 pandemic brought about an explosion in potential channels for customer touchpoints. This fragmentation will only continue, but without a CDP, it’s impossible to unify and access this type of data.

For example, CenturyLink used their Marketo Engage MAP to bring as many third-party products as possible into their activity log, then used a CDP to extract and analyze the data to create predictive models and drive change. Drawing on this data, their marketing emails alone resulted in a marketing-influenced revenue impact of $2.6 billion in one year (3). By using data from a CDP, you’re able to better define sales stages and set up actionable metrics to influence decision-making.

Lead Scoring

Finally, more accurate sourcing and scoring of leads is one of the best ways to increase marketing efficiency and improve cost per sale. With a CDP to track, unify, and deliver data on customer behavior, marketing teams can quantifiably understand the effectiveness of their efforts and identify the value of various campaigns.

One metric that a CDP can track is MQL to SQL conversion rates, to better refine lead quality and create a high-quality customer pipeline. When using a MAP alone, marketers are locked into the audience segments provided by the MAP. There is little flexibility in custom segmenting. With a CDP, you can be more precise in the personalization of ad campaigns (giving you incredible flexibility in targeting and suppression) and lowering the cost per conversion. For example, DigitalOcean used a CDP to create custom audiences for their MAP to target. This one move decreased their cost per conversion by 33% (4).

With a CDP, lead scoring can become automatic and ensure that leads are consistently and accurately tracked, scored and weighting, resulting in highly usable data and increased ROI.

Don’t Fear the Hype

Marketers shouldn’t discount the value of CDPs because of their current hype. CDPs are a valuable investment, especially in the way they can maximize the potential of MAPs. They create more robust and usable data, alleviating MAP dissatisfaction. Marketers can get greater value out of their MAPs, and improve their revenue generation (and revenue influence metrics), clean up sales stage influence, and create better lead scoring, in turn improving sales pipelines when utilizing a CDP. So there’s no need to fear that CDPs are too good to be true; when approached with realistic expectations, they fulfil their promise.

(2) https://offers.insightsquared.com/rs/054-ACZ-798/images/2019_MAP_Survery_Report.pdf