Recent events in the financial markets created substantial discomfort for the people. It brings the focus back on the operational resilience mechanisms that the Financial Conduct Authority (FCA) wants firms to implement. The events in the financial market had a negative impact on some people. Many mortgages were withdrawn; people had to change their plans for buying a home; while lots of people were facing unaffordable mortgage payments.

"Since the mini-budget we have seen much higher demand on our mortgage helplines,” Josie Clapham, Santander’s director of financial support, told the PA news agency. “Ordinarily it is not the sort of calls that my team would answer. But after the mini-budget, essentially anyone with a mortgage phoned us on any helpline."

One could argue, this was not an operational event, hence operational resilience mechanisms cannot handle this. But on the other hand, you can counter-argue, that the downstream effects caused by these events, like withdrawal of mortgage deals, were operational in nature. When a perfect storm was raging, with a war going on, central banks tightening monetary policies, energy supplies getting disrupted, and a pandemic that is still not under control; the financial market events introduced panic and threw financial markets out of gear.

This sort of chaos is what the Financial Conduct Authority (FCA) was trying to prevent when they asked firms to implement the operational resilience mechanism.

But, how does one really prepare for operational resilience, in such an unpredictable environment?

Why is there a Need to Focus on Operational Resilience?

Before we get into the question, let’s first understand why the focus on operational resilience is good for business.

In the words of the FCA,

It (Operational resilience) ensures firms and the sector can prevent, adapt, respond to, recover and learn from operational disruptions. Operational disruptions and the unavailability of important business services have the potential to cause wide-reaching harm to consumers and risk to market integrity; threaten the viability of firms, and cause instability in the financial system. The disruption caused by the coronavirus (Covid-19) pandemic has shown why it is critically important for firms to understand the services they provide and invest in their resilience.”

So, the FCA is looking at operational resilience from a big-picture perspective of the entire sector and national-level preparedness. It will ensure that when there are operational difficulties, the system as a whole would still function. For firms though, is that the only reason to focus on operational resilience? Is it a mere tick box to be ticked, to avoid regulatory sanction, or are there deeper benefits for the firms?

Let’s take a deeper look into the reasons and benefits of operational resilience.

Reputation

For firms, operational resilience cannot be just about regulatory compliance. It is also linked to their reputation. The lack of operational resilience has a direct impact on the customers, as was seen during the recent crisis. Consumers are facing financial difficulties and many of them will end up attributing their issues to the brand with which they had a business relationship.

In the long run, this would be considered a blot on the firm’s reputation, even though much of it was not of their own making. The ability to predict and handle this operational chaos could save the reputation of many a firm.

Customer experience

When the many mortgage deals were pulled, it affected customers who were in the middle of their house-buying journey. The customers had set out on this journey with an agreement in principle. But when the product is pulled off the market, in some cases the in-principal agreement reneges. Though perfectly legal, this experience leaves a bad taste in the mouth of the customer and is not an ideal customer experience.

Growth

An indirect effect of loss of reputation and a hit on customer experience is the firm’s growth. In the digital world, the customer takes the reputation of a firm very seriously and it is an important factor in their decision-making.

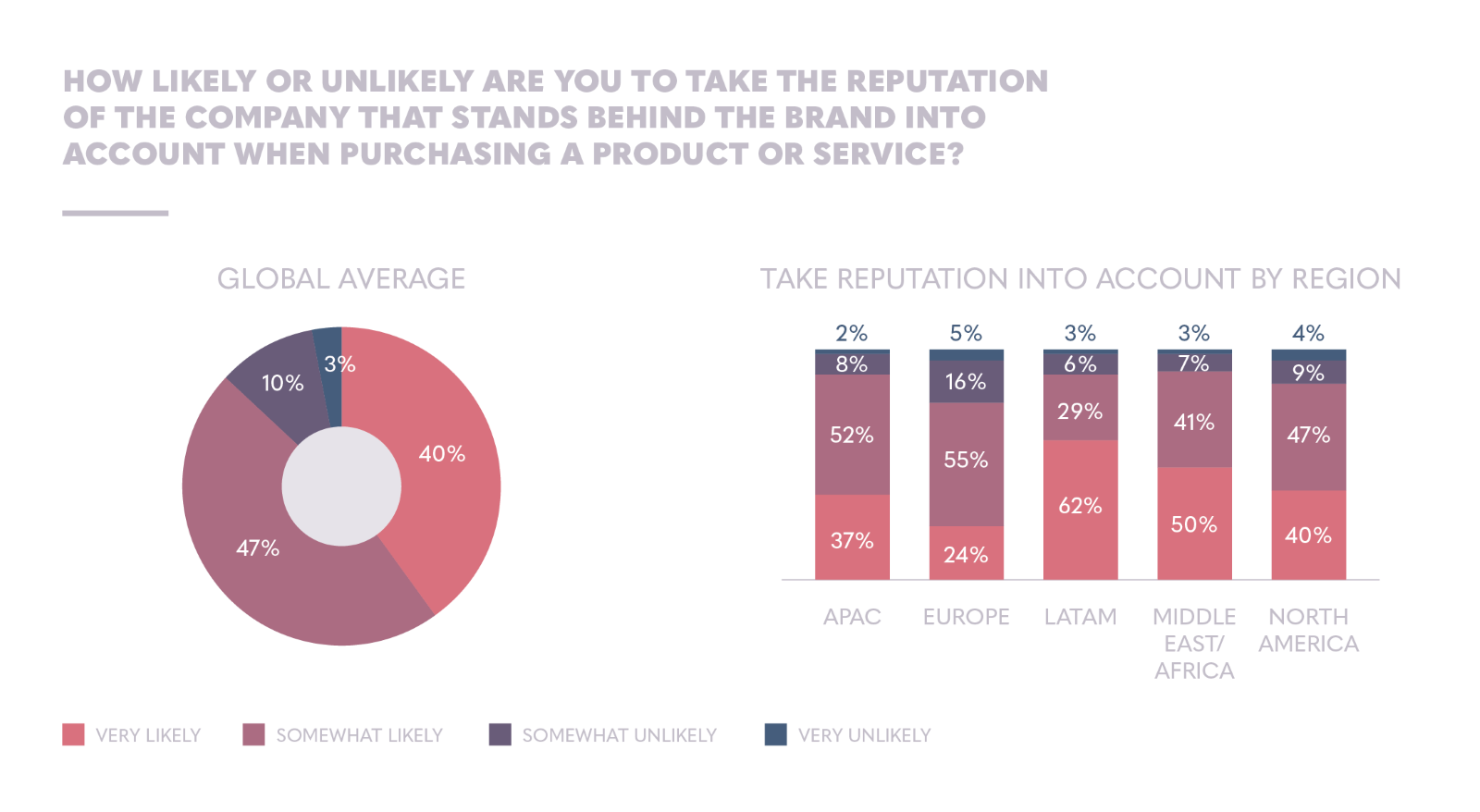

The vast majority (87%) of consumers around the world say that they take the reputation of the company into account when purchasing a product or service.

The firm’s inability to react to digital operational events in a graceful manner impacts reputation, thus it is not only a regulatory necessity but of a vital business imperative.

So, How to Prepare for Digital Operational Resilience?

The FCA suggested methods to achieve digital operational resilience are:

1) Map all critical business services

2) Set impact tolerances for those services

3) Make sure the impact of the service remains within the tolerances

It is the last leg of this triad that needs a further look.

Making sure business services’ impact remains within tolerances can be handled in a traditional way as suggested by FCA. It involves enumerating all possible scenarios when services can exceed tolerance and then having responses ready for each scenario. This method, however, has a classic flaw, as King Wuling had said,

"A talent for following the ways of yesterday is not sufficient to improve the world of today."

When you consider the reasons for business services to exceed the tolerances, you tend to consider the reasons from past experiences. Whilst it is not a bad idea and, definitely, a necessary one, it is not sufficient to handle unprecedented events. Unprecedented events can impact business services in a not-so-common way. These impacts are rather difficult to predict and address.

Also, such events are rather infrequent. Thus, should we not be prepared to handle them?

The answer to this question is another question. What is more important, the trigger or the impact that the trigger caused? It is clearly the impact that matters more than the trigger itself. It does not matter if the impact was caused by an expected scenario or an unexpected one. The impact needs to be kept under tolerance. So, how does a firm make sure the impact of any scenario, expected or unexpected, is kept under tolerance? The answer is to adopt the MOT framework.

Metrics

In order to control the impact of any operational event on consumers and stakeholders, the firms must identify lead metrics that suggest oncoming impact. For example, for the metric of moving average of call rate in the past hour; when the metric trend is moving up it suggests an oncoming surge in call volumes.

The firms must identify such lead metrics for all their critical business services when they map the services.

Observability

Once the metrics are identified, an appropriate observability framework must be put in place, which can report the metrics in real-time. The observability framework needs to have components such as data acquisition, data processing, and real-time reporting. Most business services, do have a built-in data acquisition component, however, it is the data processing and reporting components, where firms have to put the efforts in.

These types of platforms are available on public clouds as platform services (for example Azure Synapse or Snowflake). Alternatively, there are specialist services that could be used as well, if the firm does not want to build its own observability framework.

Track and Respond

The observability framework can detect the oncoming issues, which then need to be responded to with a track and response mechanism. The track and respond mechanism need to be proportional. Not all effects need the response of the same degree. The track and response mechanism should have the ability to assess the risks to consumers from the event and deploy an appropriate response mechanism.

For example, when a surge in call volume is detected, an extra number of chatbots can be deployed and some low-risk conversations which normally are handled by human agents can be routed to chatbots instead of human agents.

Such response mechanisms for all tracked metrics must be prepared and implemented. It is also important that these mechanisms are reviewed periodically for their effectiveness.

Summary

Firms must make themselves ready to address most eventualities and maintain their digital operational resilience. The maintenance of operational resilience is not just regulatory compliance but also has an impact on the business performance of the firm.

With the MOT framework in place, the firm will be ready to deal with most eventualities, enhancing the operational resilience of the firm. This will also be fully compliant with the FCA regulations. The firms have till 2025 to put such a framework in place and now is the best time any other time, to begin this journey.

References:

https://www.ipsos.com/en/how-reputation-and-trust-affect-purchase-decisions-and-marketing-efficiency