Friction is good for setting several things in motion. But, when it comes to engaging and retaining customers, a frictionless experience is mandatory. Especially in the banking sector where the digital drive has made disruptive technologies the norm. Couple this with the expectations of millennials and Generation-Z who are revolutionising how we operate. With so much change, banks and other financial institutions must rethink their business models for the future.

And. what better way to deliver a frictionless digital experience than to combine artificial intelligence(AI) with data for advanced analytics and machine learning. As transactions continue to move from physical to digital channels, it becomes imperative for financial services providers to apply big data insights and machine learning to transform internal operations, customer experiences and the competitive landscape.

AI Driven Digital Banking

A study conducted by a leading consulting firm, on automating the interaction between different tools and people in an IT environment at a New York-based investment bank led to the discovery that AI is not just hype. As a result of AI, the bank achieved a 93 percent reduction in average resolution and fix time. This was a significant reduction from 47 minutes to 4 minutes.

According to the Financial Brand, AI will help usher in a new era for digital banking, in the front-office and back-office. A survey of bankers presented the following results.

- 79% believe AI will revolutionise how banks gather information and interact with customers

- 71 % believe that AI is capable of becoming the face of their organisation or brand

- 76% say that within three years banks will deploy AI as primary method of customer interaction

- 29% believe it is important to offer their products/services through centralised platforms/assistants or messaging bots

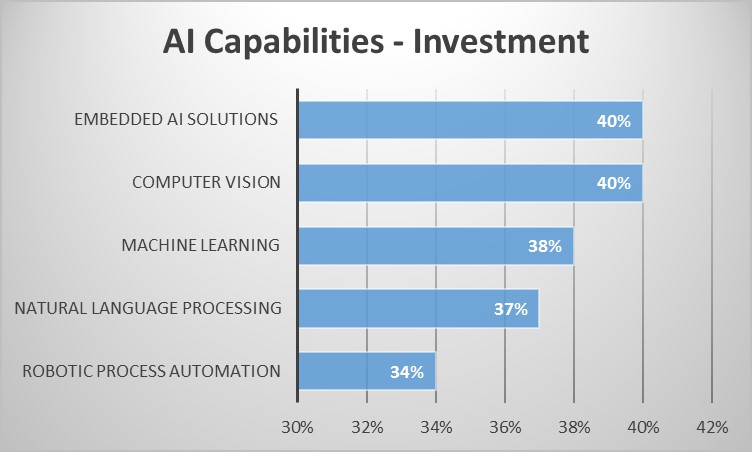

As a result, banks plan to invest in the following AI capabilities extensively in the next three years.

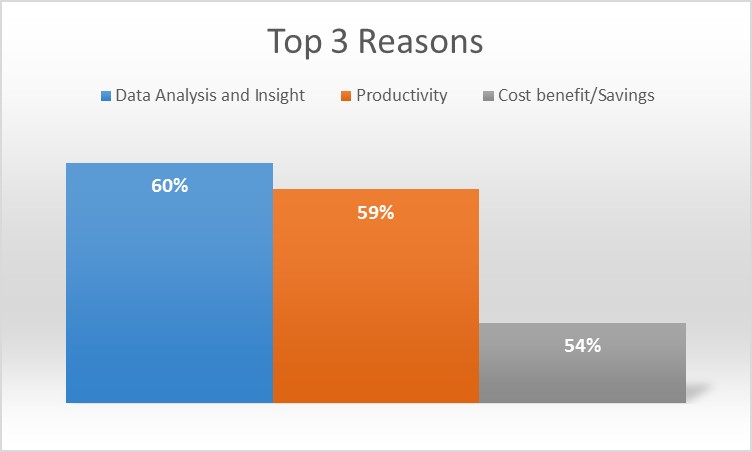

While the banking industry may not expect higher returns on such investments, they have highlighted their top three reasons for embedding AI into user interfaces.

Empower with AI

It must be noted though that AI is not a new concept for banks. The technology is used in predominantly manual processes to deliver accuracy, efficiency, speed and cost benefits. In recent times however, AI has moved beyond processes. It is enhancing customer experience and simplifying workflows, to gain market share and drive higher revenues. It can be harnessed for business growth by acquiring meaningful data insights, allowing banks to create audience segmentation and understand the demands of such segments.

In the future, those with superior technological capabilities are not the ones who will thrive. Rather, those with the ability to utilise technology to empower people within and outside the organisation.

Anticipate Customer Needs

Findings from other industries demonstrate that the application of big data and machine learning improves understanding of customer beliefs and intentions. It can help deliver enhanced customer experiences and improve competitive positioning. For example, machine learning can adapt data and interactions to quickly detect fraud. It can also leverage AI-enabled tools such as chatbots to create contextual customer interactions.

AI allows enablers to design technology capable of thinking like humans, and as a result, advances their wants and needs. This human-centred technology approach will help companies to transform their relationships from provider to partner, even as they experience an internal organisational transformation.

Go from Mobile First to AI First

A true touchless experience is also possible with AI. For about a decade now, going mobile to gain market and drive revenues has been the focus of most businesses. As customer expectations revolve around the digital world, we believe that it is now time to make the shift from mobile to AI. Google CEO Sundar Pichai summarised the Google I/O 2017 keynote by declaring, ‘An important shift from a mobile first world to an AI first world’.

Traditional banking has been supplemented by net banking, which was introduced by the Web 2.0 era, which further evolved into mobile banking as we ushered in the Web 3.0 era. Eventually, this became the preferred banking mode for most customers and continues to remain so today. With advances in AI, customer experience will be enhanced without the need for interacting through the click of a mouse or tappinga screen.

The use of Natural Language Processing (NLP) with virtual assistants make it a reality for customers to have their own intelligent banking assistant who they can communicate by simply speaking in a natural language. This is similar to conversing with another individual; only, this assistant is far quicker than anybody else, understands customer needs and has total insight. Moreover, it can also predict customer demands. The potential is just tremendous.

Overcome Data Usage Hurdles

If banks are to benefit from this disruptive technology, then a well-defined strategy must be in place for data collation and usage. This is because data privacy and trust issues on the part of customers towards banks may hamper progress.

The manner in which customer data will be used should be agreed by the customer and the bank. As also the role that AI systems perform to derive value from the data. This flexibility and agility will go a long way in supporting a scalable environment for test or learning purposes, as well as to explore the feasibility of AI capabilities.

Want to make financial services transactions a seamless and simplified experience for your customers? Connect with us at info@mastek.com to find out how AI capabilities can help you be responsive to customer needs.